December 6, 2022

Where did the tax credit come from?

The Employee Retention Tax Credit (known as ERTC or ERC) was enacted as a part of the CARES Act in March 2020 offering eligible business up to $26,000 in a dollar for dollar refundable tax credit per W2 employee.

In 2020 and 2021, many businesses took advantage of PPP loans to stay afloat during COVID. Up until the enactment of the Taxpayer Certainty and Disaster Relief Act (TCDTR) passed in December 2020, a business was only eligible for ERC if they had not been the recipient of a PPP loan. You were required to choose one or the other. After TCDTR was enacted, it allowed businesses who previously had received PPP loans to also be eligible to claim the ERC. Please note that the Employee Retention Tax Credit is an entirely different tax benefit altogether. A business who was the recipient of a PPP loan(s), is not precluded from being eligible for ERC.

Who’s eligible for the tax credit?

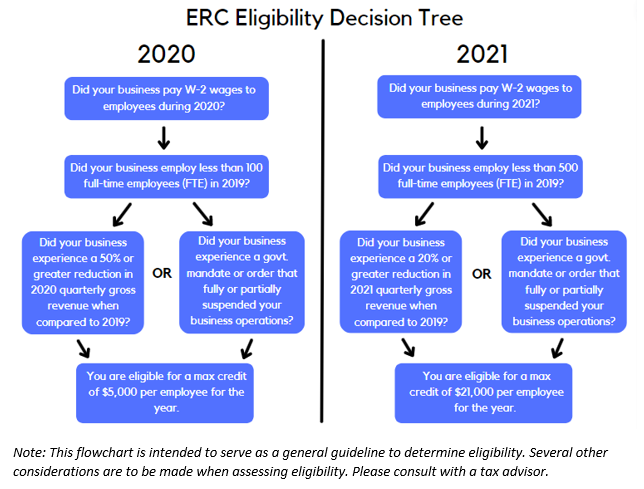

A business must meet the qualifications to be eligible to claim the credit. The decision tree flow chart below provides a general guideline on determining eligibility. Businesses are often times eligible when they think they may otherwise not be so it’s important to consult with an CPA who has experience with ERC.

How is the tax credit calculated?

The credit provides up to $5,000 per employee for 2020 and $7,000 per employee, per quarter in 2021. 2021 Q4 is only eligible to businesses defined as recovery startup businesses.

To demonstrate the potential of ERC, we’ll provide you with an example. Assume that Widgets, Inc. employs 20 W-2 employees and that they meet the criteria to be eligible for ERC in all quarters during 2020 and 2021. Let’s assume that the average annual wages paid to each their employees is $60,000 and they received both PPP1 and PPP2 loans during 2020 and 2021. In this particular scenario, Widgets, Inc. would be eligible for a credit of approximately $520,000! We’ve seen this type of credit absolutely revitalize a struggling business or simply provide a much-needed capital infusion to ignite growth.

How do you claim the tax credit?

The credit is claimed by filing amended Form 941(s) for each eligible quarter(s). The IRS statute of limitations allows eligible businesses to claim this credit up until 4/15/2024 for the 2020 tax year and 4/15/2025 for the 2021 tax year. The credit is refundable and paid directly to the business. You’ll want to file the credit sooner rather than later to start the clock on when the credit funds. As of the date of this article, it’s taking the IRS roughly 3-4 months to process and fund the credit.

There are several rules and nuances surrounding ERC eligibility. Some of those include the definition of gross receipts and suspension of operations, wage allocation for PPP loans and aggregation of multiple entities. You can find additional detailed information about ERC provided by the IRS. It’s highly recommended to consult with a tax adviser when assessing credit eligibility. If you’d like a free consultation to discuss ERC, please feel free to reach out to us or emailing us at info@hart-cpa.com. Thank you!