December 6, 2022

LLCs, partnerships, S elections, self-employment tax, legal liability – these are all terms you may hear when looking into what type of entity to choose when starting a new business. To most people it can be confusing, and it can be overwhelming. We’re here to help make sense of it all.

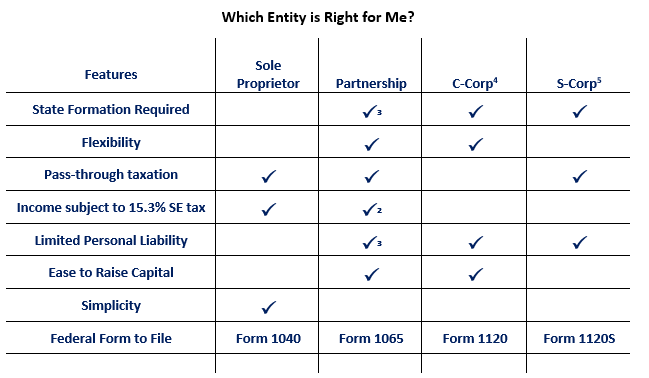

Each entity type has something to offer and is inherently different by nature. There is no right or wrong choice. What may be the right choice for one business, may not be the best for another. The chart below breaks down features of each entity type. The chart is intended to be a general guideline only. It’s highly recommended to seek counsel from a CPA and/or attorney before making a decision.

With as much attention as LLCs have gotten over recent years (and rightfully so), you may be wondering why they aren’t included above. An LLC is a legal entity type recognized by the laws of the state it’s formed in. However, for federal tax purposes, it is not recognized. Meaning there is no Federal Form that you can use to file an LLC tax return. It’s merely just a legal entity structure. An LLC offers ultimate flexibility when it comes to choosing how your business is taxed. When you create an LLC, you have the option to have it taxed one of four ways included above for federal tax purposes. Its flexibility and many other advantages, make it an attractive option for many.

If there is only one member (owner) of the LLC, it’s treated as what the IRS calls a disregarded entity. A disregarded entity is not required to file its own separate business tax return. Instead, the LLC is captured in the sole member’s personal tax return. By default, the IRS will assign disregarded entity status to a single member LLC unless an election is filed with the IRS indicating otherwise. If the is more than one member (owner) of the LLC, the IRS will assign its default entity selection as a partnership unless an election is filed with the IRS indicating otherwise.

Regardless of how many members (owners) there are, an LLC can also elect to be taxed as a C-Corporation by filing Form 8832 or an S-Corporation by filing Form 2553. There are deadlines on when these elections are to be filed; however, the IRS is generally willing to grant late filing relief.

2 Only a general partner(s) (a partner who partakes in managing the business) are subject to 15.3% self-employment tax on income earned in the partnership. Limited partners (a partner who doesn’t partake in managing the business) are not subject to 15.3% self-employment tax on income earned in the partnership.

3Only limited partnerships offer personal liability protection and require state entity formation. General partnerships do not offer limited personal liability protection and don’t require state entity formation.

4 C-Corps are subject to a flat tax rate assessed at the corporate level. Any dividends paid to shareholders incur an additional dividend tax assessed at the shareholder level. This is what is referred to as double taxation.

5 S-Corps require a reasonable W-2 salary be paid to its shareholders. These W-2 wages are subject to 15.3% self-employment tax (split 50/50 between the business and the individual shareholder).

You can schedule a free consultation to discuss which business entity is the best for you.